Real estate has always been one of the most stable asset classes, but it is also one of the least accessible. High capital requirements and complex ownership structures often keep smaller investors out. With blockchain technology, however, the idea of tokenizing property is gaining traction.

This raises an intriguing question: could the qualities of modern residential design themselves become part of the value proposition in crypto-enabled real estate finance?

At Tengah Garden Residences, residential design trends showcase how architecture and lifestyle features are evolving. Smart layouts, eco-friendly systems, and community-driven spaces are no longer just aesthetic choices. They are quantifiable attributes that could influence how a property is valued, both in traditional markets and in tokenized digital finance.

Design as a Measurable Asset

Investors have long considered location, square footage, and amenities when evaluating property. But design is increasingly measurable. Flexible floor plans, integrated smart home systems, and sustainable energy solutions can be tracked and compared. These features add tangible value, making them ideal candidates for inclusion in blockchain-based investment models. If fractional ownership tokens or real estate NFTs become mainstream, design-led qualities could directly impact token pricing.

Smart Homes Meet Smart Contracts

Smart home technology is a natural fit for tokenized real estate. Features such as automated lighting, energy-efficient cooling, and app-based security systems enhance both livability and long-term value. When tied to blockchain, these features could be represented as metadata within a property token. Investors would not just own a fraction of a building, they would own a stake in a technologically advanced living space with measurable efficiency gains.

Sustainability as a Driver of Crypto Capital

Eco-centric design is no longer a niche preference. Tengah’s emphasis on green corridors, energy-efficient layouts, and reduced carbon footprints reflects a global trend. Crypto investors, often drawn to projects with real-world utility, may find sustainable design especially appealing. A token representing a property with strong environmental credentials could attract a new demographic of investors who value both profit and impact.

Community Spaces and Fractional Ownership

Modern developments increasingly prioritize shared spaces: co-working areas, fitness centers, and landscaped gardens. These features foster community and enhance lifestyle appeal. In a tokenized model, such amenities could be factored into fractional ownership tokens. Investors might see higher demand for tokens tied to properties with strong communal infrastructure, as these spaces increase rental potential and long-term desirability.

Lowering Barriers to Entry

Tokenization could transform property investment by lowering entry costs. Instead of needing hundreds of thousands of dollars, investors could buy tokens worth a fraction of that. This democratization of access could open real estate markets to younger investors, crypto enthusiasts, and those seeking diversification. Residential design trends that emphasize flexibility and sustainability would make these tokens even more attractive, as they align with modern lifestyle expectations.

Challenges Ahead

Despite the promise, hurdles remain. Regulatory frameworks for tokenized real estate are still evolving. Governments must balance investor protection with innovation. Technology infrastructure also needs to mature, ensuring secure transactions and reliable valuation models. Questions around whether real estate accepts crypto as payment highlight the broader uncertainty. Without clear rules and robust systems, tokenization risks being seen as speculative rather than transformative.

The Future of Design-Driven Tokens

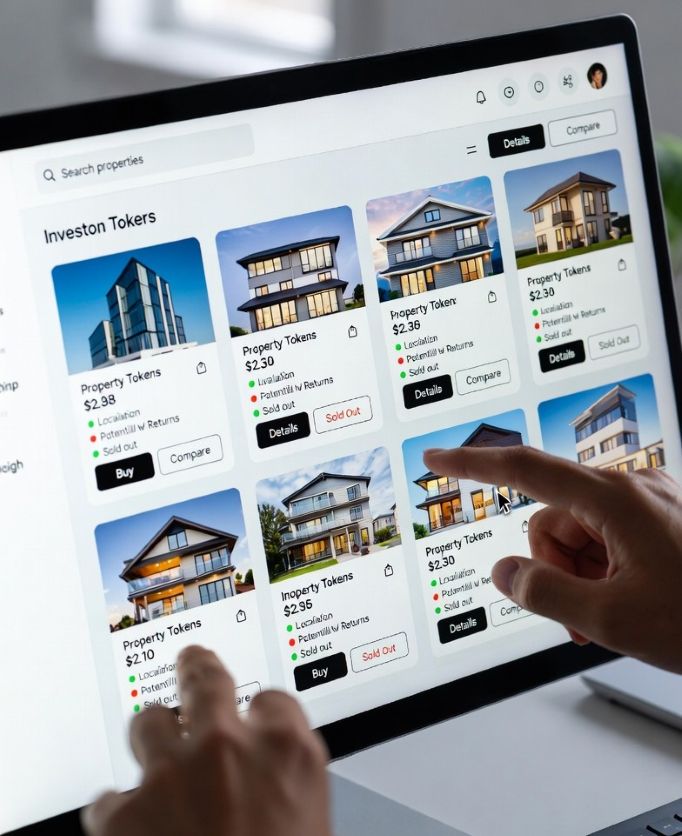

Imagine a future where investors browse digital marketplaces for property tokens. Each listing highlights not just location and price, but design features: smart energy systems, flexible layouts, and eco-friendly certifications. Tokens tied to properties with advanced design could command premiums, while those lacking modern features might lag behind. This would create a feedback loop where developers prioritize design innovation to maximize token value.

Conclusion

The convergence of blockchain and real estate is still in its early stages, but the potential is clear. As residential design trends continue to evolve, they may become key drivers of value in tokenized property markets. Smart, sustainable, and community-focused design could attract crypto capital, reshaping how people invest in and experience housing. The path forward depends on regulation and technology, but the idea of design-led tokens is no longer far-fetched. It is a glimpse into how the future of living spaces might merge with the digital economy.

The clash between the U.S. Securities and Exchange Commission (SEC) and the

The clash between the U.S. Securities and Exchange Commission (SEC) and the